The Problem

Bluestone is a leading supplier of mortgages for individuals with complex credit histories. Yet while their products are excellent, they had very little brand awareness or market share within the mortgage broking community.

Objectives

Following on from the success of our ‘The Unlendables’ Campaign last year, Bluestone wanted to drive additional lending for the remainder of 2022 and 2023. In addition to the KPIs below, Bluestone wished to drive broader Brand Awareness with direct consumers as well as to drive initial interest in their BlueSky Platform which was due to launch in early 2024. Our key targets were therefore:

BlueSky Register Button clicks

Increase in Email Engagement

Toolkit downloads

Inactive database to active applicants

The Big Idea

In Part One of the campaign, we had created an eclectic family of characters called the ‘Unlendable Family’. Each character represented the mortgage needs and credit circumstances of a specific type of end customer. The unique, relatable and catchy concept with high-quality, versatile visuals was crucial to the success of the campaign. So, in part two, we extended The Unlendables concept by having them invite their mortgage broker Ben to dinner, as a mark of their appreciation for getting them all the right Bluestone mortgage.

The Creative Solution

The unique, relatable and catchy concept was brought to life with high-quality, versatile visuals. This comprised high impact video, still image and email design created by our in-house team: all custom made for digital marketing in image sizes, text and quick turnaround for approval process purposes. We also created multiple 6, 15, 20 and 30-second videos – for the whole family and for individual characters.

Our Micro Stories

Bluestone offer 5 main mortgage products for sub-prime customers. To bring these to life, we created characters and back stories that reflected the needs and individual credit circumstances of their five most typical customer types.

Campaign Activation

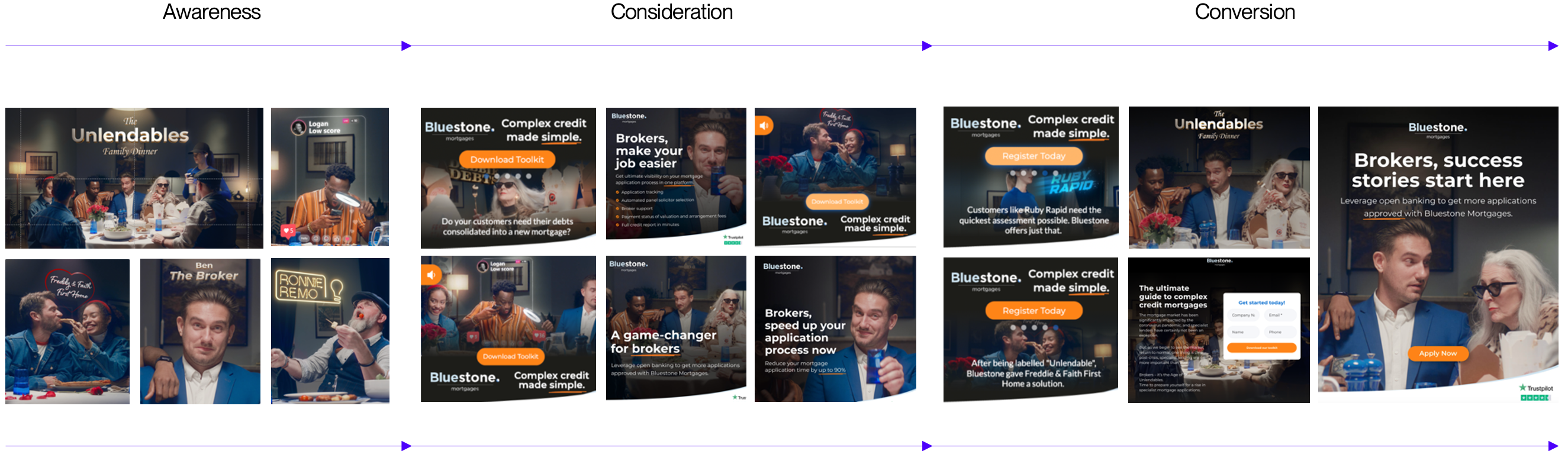

To support our hero ad, we created a total of 30 individual creative assets to support the end-to-end acquisition of new broker customers. These included a range of ad cut-downs as well as additional collateral and bespoke campaign landing pages. To ensure the overall success of the campaign we adopted

a systematic approach that:

- Identified the key customer touchpoint across every

stage of the buying journey - Tested multiple audience segments to find pockets of untapped opportunity

- Used existing partnerships and tactical placements to create brand affinity

and build a stronger connection with the audience - Used a mixture of sophisticated targeting and automation to create

bespoke customer journeys for all our different personas - Tested multiple lead and conversion incentives to lift conversion rates

Our Customer Journey

We needed to take people on a journey through our targeted messaging and content. It was the journey through all these key phases and touchpoints that converted prospects into customers and customers into followers and advocates.

Our Results

After our 4-month campaign, we had exceeded every KPI set at the start of the engagement: achieving the following headline results.

Registration Enquiries

Leads Generated Over Target

Increase in Email Performance